The mindset of an individual investor and that of a savvy, ultra-wealthy investor are very different. Driven by emotion, the constant search for excitement, and being part of the crowd, average individual investors gravitate toward speculative investments despite their inherent risks and high probability of failure. In contrast, savvy ultra-wealthy investors prefer stable, long-term, income-producing assets like commercial real estate.

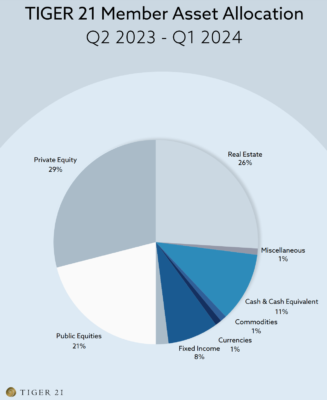

The chart below illustrates how the ultra-wealthy gravitate towards stable assets like commercial real estate over speculative investments like public equities:

As evidenced by the chart above, according to the asset allocations of the ultra-wealthy, like those of the members of the exclusive investing network Tiger 21, the ultra-wealthy prefer real estate over public equities by a large margin.

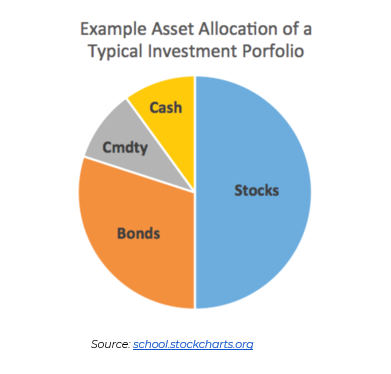

Compare this to the typical asset allocation of the average individual investor:

Why the Difference?

Why is there a difference in allocations between the ultra-wealthy and the average investor? It’s all about mindset and objectives. While the average investor is an emotional investor, the ultra-wealthy take a more rational and methodical approach.

This difference in mindset explains why the average investor chases speculative stocks while the sophisticated investor prefers reliable income-producing assets like commercial real estate.

The Emotional Investor and Common Mistakes

The average investor is driven by emotions and biases that lead to irrational collective behavior. Individual investors can best be characterized as noise traders. Noise traders make decisions based on what they read and see on the internet, cable news, and social media. They are more focused on short-term market fluctuations and news than fundamental economic analysis. This approach often results in buying overhyped stocks that underperform.

Noise trading leads to speculative “manias” and “panics” that drive market volatility. Speculative manias are characterized by price increases due to collective hype and euphoria. What goes up must come down, as these bubbles eventually lead to panic when the bubble bursts. Historical examples include the dot-com bubble and the housing crisis. Emotional investing, characterized by herd behavior and FOMO, will always be a part of the fabric of the public markets.

Human nature can also explain the pull on individual investors to engage in active investing. Active trading is a common pitfall for individual investors.

According to Brad M. Barber and Terrance Odean in “Trading is Hazardous to Your Wealth,” active traders generally underperform the market. Overconfidence, especially among men, leads to excessive trading and poor returns, driven by speculative decisions detrimental to overall portfolio performance.

Human nature fuels speculative stock investing, but at its core, stock speculation is driven by the short-term mindset of investors looking to time the markets to hit the next home run. It’s a losing strategy, but human nature is hard to overcome.

Savvy Investors and Long-Term Strategies

In contrast to the average investor’s speculative mindset, savvy investors focus on stable, long-term investments that generate consistent income and are less susceptible to market volatility. They take emotion out of the equation because they know emotions lead to irrational investment decisions. A long-term mindset draws savvy investors to commercial real estate, where sophisticated investors can grow wealth while ignoring the noise of the markets.

Why Commercial Real Estate?

Commercial real estate stands out as a preferred investment for seasoned investors because it offers a combination of income stability and potential appreciation while being less volatile than the stock market. Long-term leases provide steady cash flow, and the tangible nature of real estate adds a layer of security by securing the investment with a hard underlying asset. This stability is particularly appealing compared to the erratic performance of speculative investments.

Advantages of Commercial Real Estate

- Inflation Hedge. Real estate serves as an excellent inflation hedge. As the costs of real estate—land, construction materials, etc.—rise over time, property owners can capture higher rental rates and asset appreciation. Publicly traded stocks do not have the same direct ability to rise alongside inflation.

- Tax Advantages. Real estate comes with multiple tax advantages that Wall Street investments do not match. Property owners can deduct expenses like mortgage interest, property taxes, and operating costs. They can also use depreciation as a tax write-off. When invested in the right vehicles, real estate gains may receive more favorable tax treatment than ordinary income.

- Cash Flow. For savvy investors, cash flow is the key to wealth building, and commercial real estate provides steady incoming cash flows from rents that publicly traded investments cannot match.

- Leverage. One unique advantage of real estate over traditional investments is the ability to utilize leverage through secured mortgages to acquire investment properties. When used wisely, leverage can significantly boost returns on real estate above what would be possible through stocks, which cannot be bought on margin at such high levels.

- Lower Volatility. Real estate returns tend to be far less volatile than the wild swings seen in most public equity investments. Lack of daily pricing creates stability, and properties retain their demand and value even during downturns.

The stark contrast between the average investor’s speculative tendencies and the savvy investor’s preference for stable, long-term investments highlights the importance of discipline and a long-term mindset in successful investing. While speculative investments may appeal to the masses because of their potential for high returns, the associated risks and behavioral pitfalls often lead to failure.

In contrast, focusing on stable, income-producing assets like commercial real estate provides a more reliable path to wealth accumulation and financial security. It’s why the ultra-wealthy allocate heavily to this asset class in their portfolios.